Steepening. The U.S. Federal Reserve still managed to deliver a surprise to markets this week. While it had long ago become a forgone conclusion that the Fed would be lowering interest rates for the first time in more than four years since the onset of COVID, it upped the ante come press conference time by announcing a half point cut to the fed funds rate. This was a big move in contrast to the mantra of being deliberate and marginal with changes to monetary policy. So why the fifty point rate cut, and what are the implications for the markets as we move through the remainder of 2024 and into 2025?

Clear. At first glance, the Fed’s decision to go 50 bps out of the gates may appear curious. It seems like an aggressive move, after all, given the current economic and market backdrop. Consider the following.

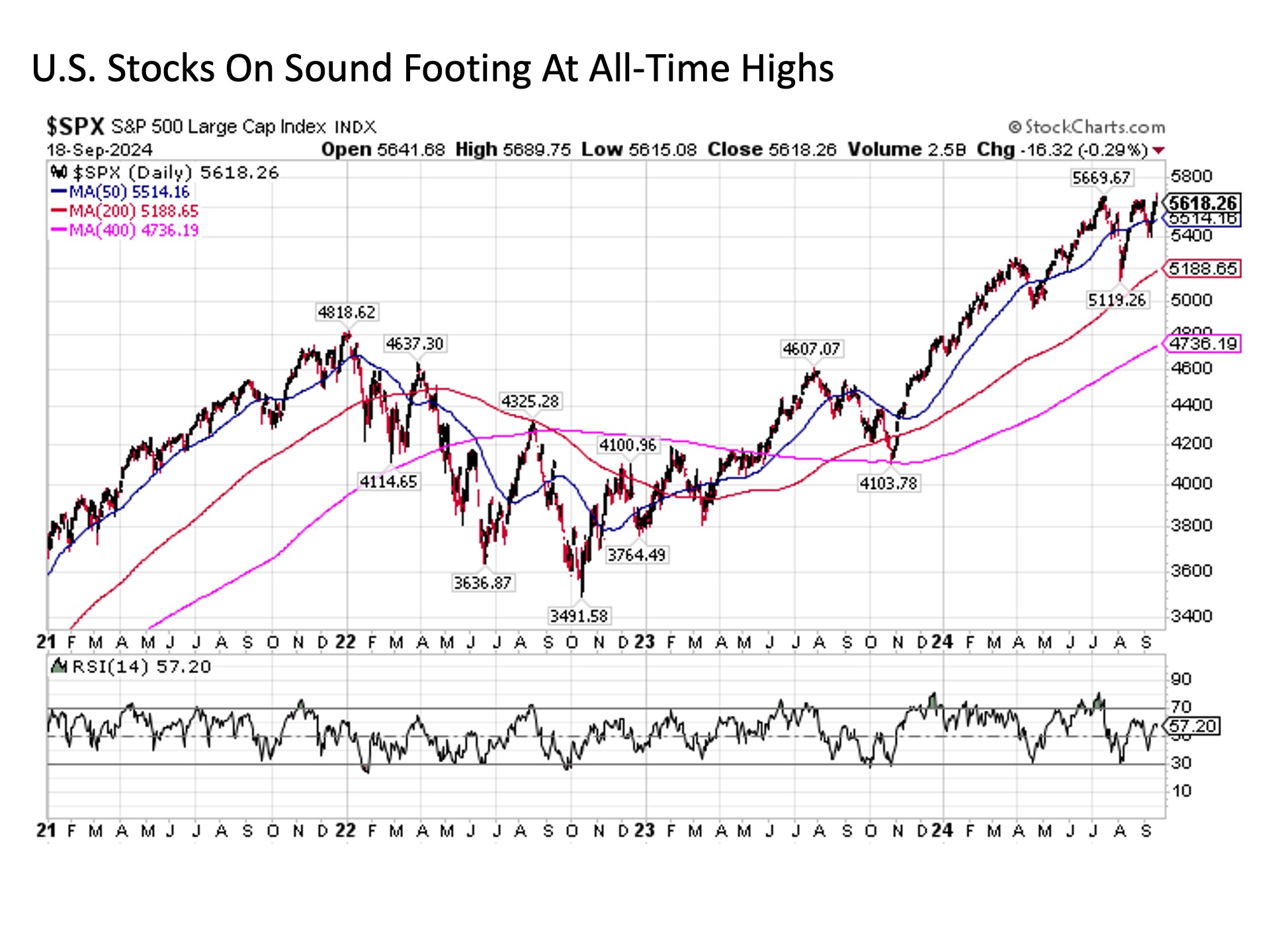

The U.S. stock market is still setting new all-time highs.

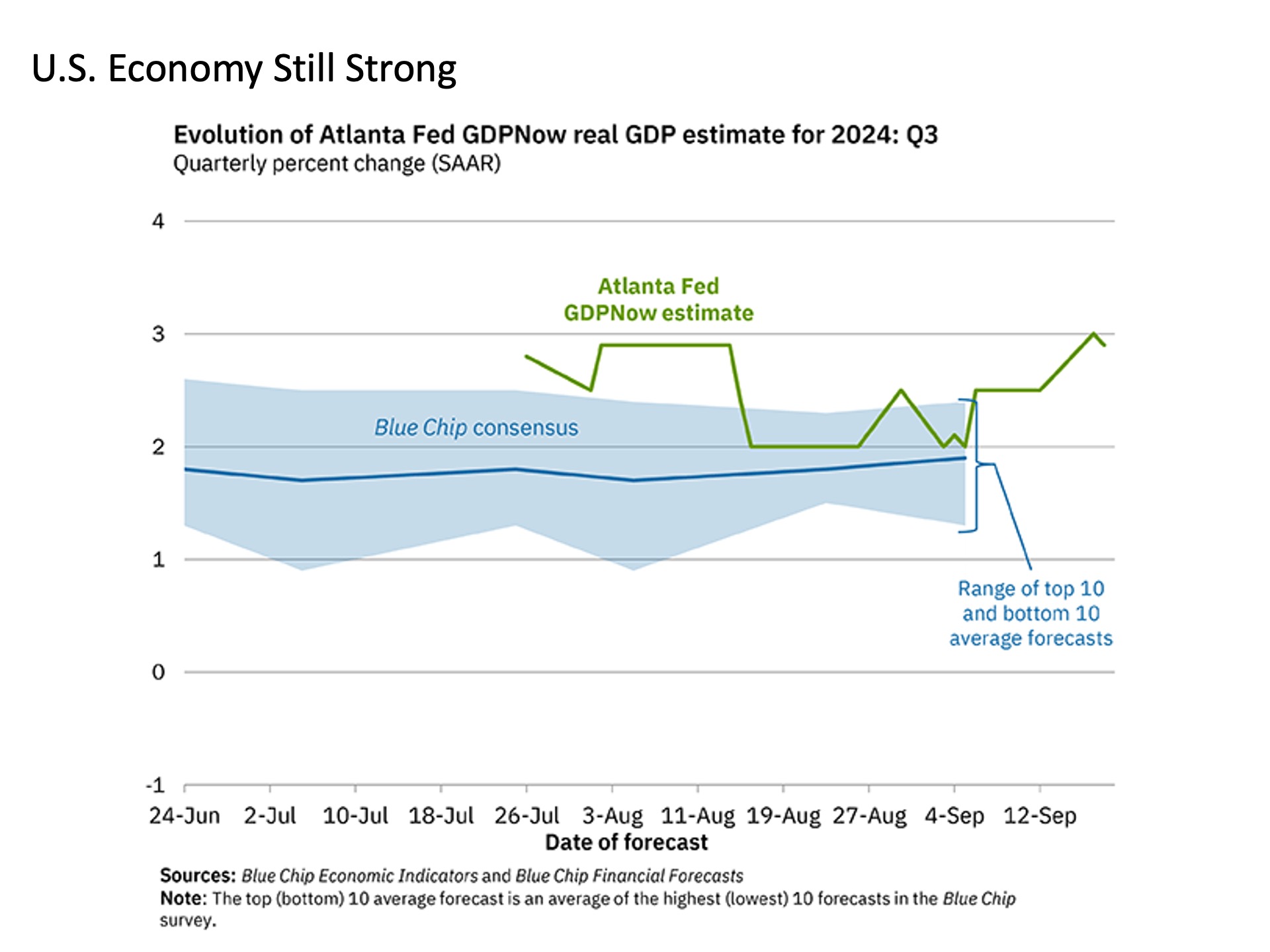

The U.S. economy continues to expand at a healthy rate.

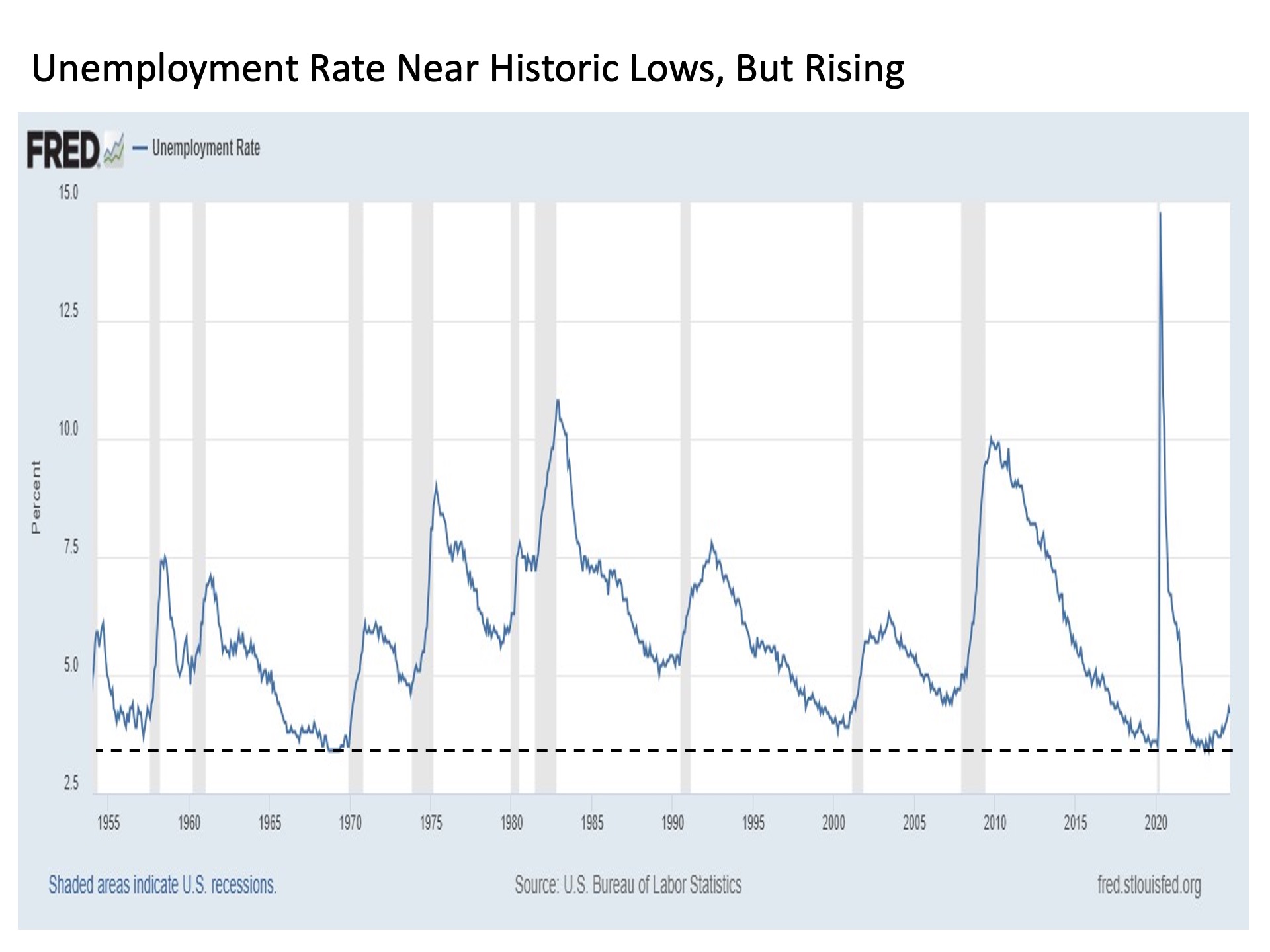

The unemployment rate has ticked higher over the past 18 months, it remains not far above historic lows.

All of these factors signal an economy that is doing just fine and hardly the conditions that would suggest the Fed needs to go in for a double right out of the gates.

Clouds on the horizon. Of course, it is important to remember that the Fed isn’t necessarily managing monetary policy for the economy right in front of its face today. Instead, just like the stock market will move today to price in outcomes it anticipates six to eighteen months down the road, so too is the Fed seeking to adjust interest rates now in anticipation of the economy it anticipates over the coming year and beyond.

This element adds to the intrigue of the Fed’s decision to go bigger in cutting by a half point on Wednesday. With much of the economy seeming to be rolling along just fine today, what exactly might the Fed be seeing that the rest of us don’t know to cause them to move more aggressively? Do we have something more to worry about?

The more likely answer to these questions is not crystal ball related. The Fed is very likely reading from the same playbook as the rest of us. It’s more likely that they wanted to make a statement out of the gates that they are serious about fighting any looming economic slowdown in finishing the job of bringing the U.S. economy in for a soft landing following the inflationary outbreak in recent years.

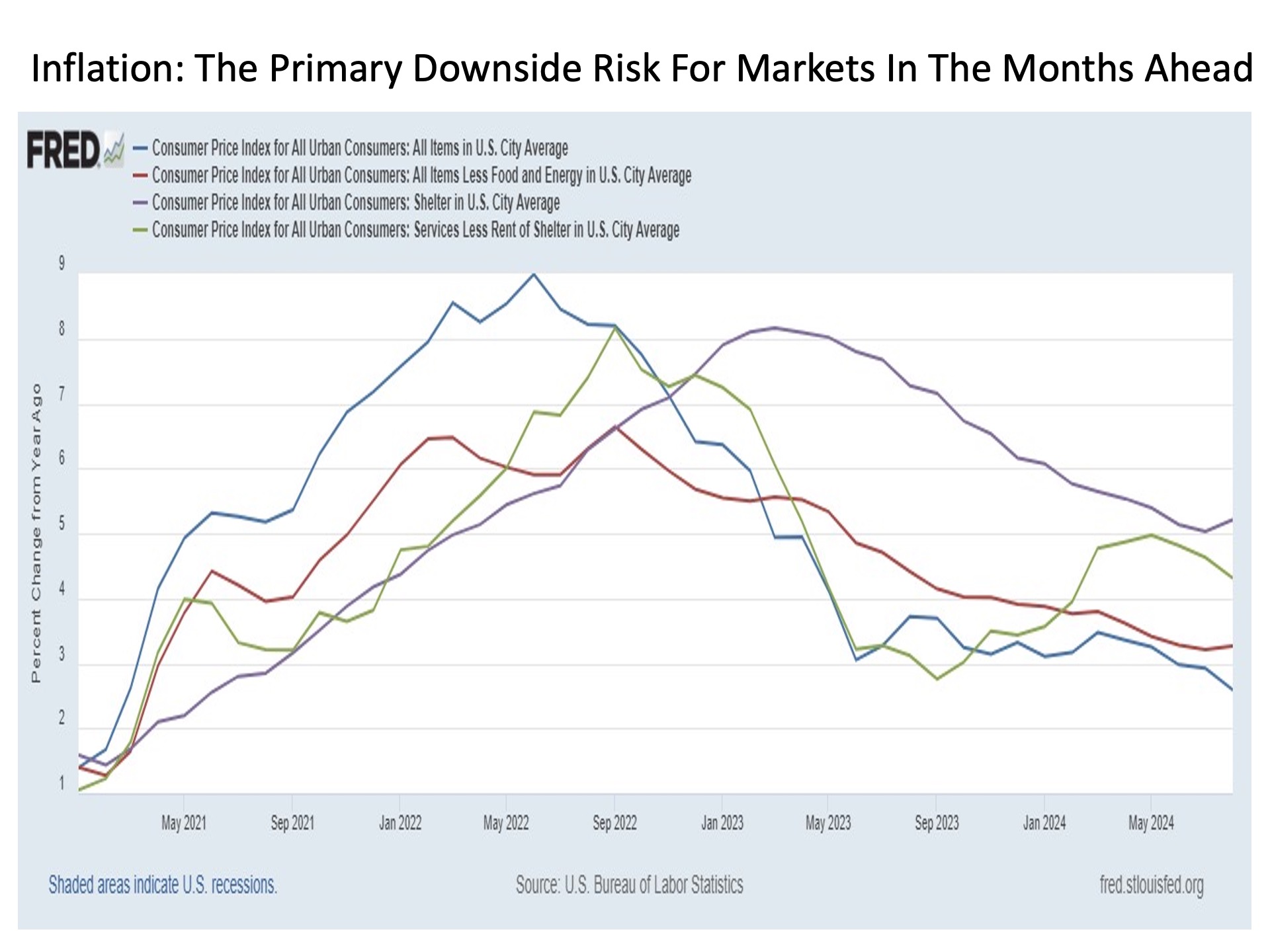

The primary downside risk. This brings us back to the primary downside risk for financial markets that has loomed dating back for more than a year now. The Federal Reserve put their foot through the floor in jacking up interest rates back in 2022 and 2023 to fight the inflation fires. And since the second half of 2022, we have seen pricing pressures by a variety of measures peak and steadily decline since. But in the aftermath of the worst bout of inflation in the U.S. economy since the early 1980s, the threat has persisted that the inflationary fires might not only rekindle themselves but come back even worse. This after all, was the repeated dilemma that dogged monetary policy makers throughout the 1970s and into the early 1980s – cut monetary policy too soon in response to economic weakness and a new case of inflation comes back more scorching than it was before. Such is the risk confronting monetary policy makers today.

At first glance, markets appear sanguine about future inflation prospects. The 5-year breakeven inflation rate remains at its lowest levels of the decade at a level just below the Fed’s target rate of 2%.

And the 10-Year U.S. Treasury yield continues to fall precipitously from its October 2023 and April 2024 highs, suggesting that the market is far more concerned today about the prospects of economic weakness ahead, not a renewed rise in pricing pressures.

These are reassuring signs suggesting the Fed has the flexibility to come out swinging with its initial round of rate cuts. Nonetheless, it remains critical in the weeks and months ahead to monitor inflation readings closely for any new pricing fires starting to burn.

For example, while headline CPI (blue line) continues to decline on an annualized basis, it is noteworthy that the Core CPI excluding food and energy (red line) recently ticked higher, albeit modestly. And while services inflation (green line) appears to have rolled back over after a renewed surge dating back to last year, the rent of shelter component of CPI (purple line) also recently ticked back higher. Single data points do not trends make. However, if we see inflation readings such as these starting to move sustainably higher in the months ahead, it may require the Fed to not only cease their dawning rate cutting cycle, but it may ultimately force them to resume raising interest rates. And both the stock and bond markets would not like that outcome one bit.

Bottom line. The Fed is out of the gates strong with their latest monetary policy easing cycle with a half point rate cut. While the effort may reinforce the Fed’s recession fighting chops, it puts an added spotlight on the risk of renewed inflationary sparks that may eventually come as a result. This will be a key theme to watch in the months ahead.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 633379-1